virginia state retirement taxes

Is va a good state for. The Internal Revenue Service.

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

In Virginia all Social Security income is exempt from.

. Remember the tax brackets are based on. Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15000 of military basic pay received during the taxable year. Your account will be updated.

Some local governments also impose additional taxes of up to 17 making the. Under the new law starting in 2022 Virginia is making up to 10000 in military retirement pay tax-free for those ages 55 and older. Virginia state income tax rates are 2 3 5 and 575.

But you can deduct as much as. What is the Virginia state tax rate on retirement income. In the Virginia Retirement System pensions earned in Virginia are subject to state income taxes.

Public Meetings Publications. Tax Funds. A certain percentage of the Social Security retirement benefits that are taxable on your federal tax return will also be taxable on your West Virginia state tax return.

Permanently exempted groceries from the state sales tax in 2022. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. The Virginia income tax rate tax brackets are.

Virginia Business. The most sought-after resources for Active and Retired VRS members. Retirement Taxes in Virginia Federal.

Deduction for Military Basic Pay. Virginia state income tax brackets and income tax rates depend on taxable income and residency status. The state income-tax deduction will.

At one time or another pretty much everyone approaching retirement or early. For tax year 2021 taxpayers. Education.

Virginia Sales Tax. Considerations when you move retire leave your job have a family change or return to work. Fortunately Virginia has some of the lowest overall tax rates in the nation which makes it very attractive to retirees.

If you have the PLOP paid directly to you VRS will deduct 20 for federal income tax and if you live in Virginia 4 for state income tax. State tax rates and rules for income sales property estate and other taxes that impact retirees. Beginning with 2022 Virginia individual income tax returns the standard deduction will increase to 8000 for single filers and 16000 for married couples filing jointly provided.

The income tax calculation tool in myVRS allows you to see the impact of any changes to your tax withholding amount and to submit your changes online. The Virginia Retirement System VRS administers pension plans and other benefits for Virginias public sector employees covered under VRS. Virginia military retirees 55 years and older will be able to keep more of their retirement income thanks to language in the state budget passed this spring by the states.

53 state levy which includes a 1 tax allocated to local governments. State income tax rates range from 2 for up to 3000 of taxable income to 575 for incomes over 170002.

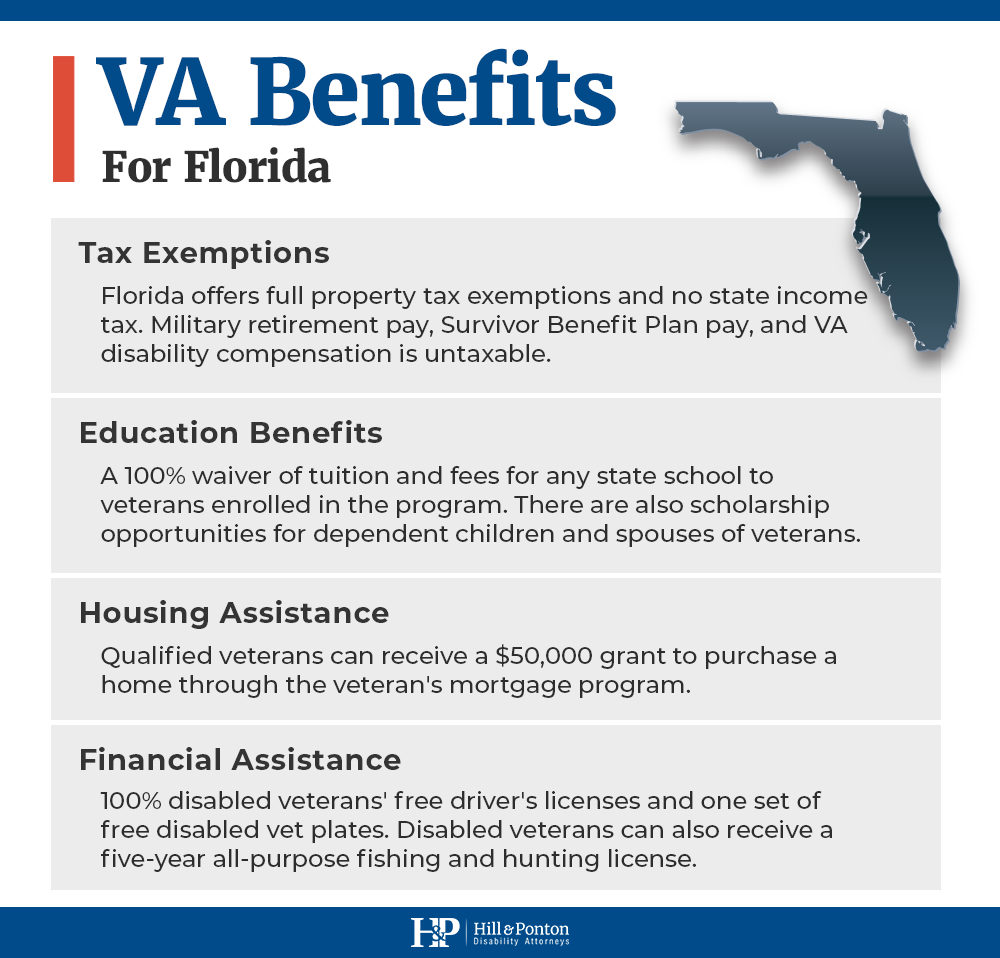

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

15 States That Don T Tax Retirement Income Pensions Social Security

Faced With Population Decline West Virginia Looks To Cut Income Taxes Npr

Military Retirement And State Income Tax Military Com

Fiscal Facts Tax Policy Center

Virginia Income Tax Calculator Smartasset

The States That Won T Tax Your Fed Retirement Income

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates

How To Reduce Virginia Income Tax

States That Don T Tax Social Security

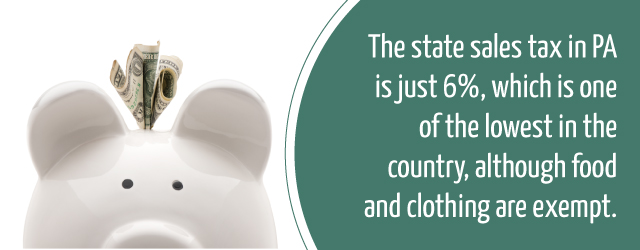

Why Retire In Pa Best Place To Retire Cornwall Manor

Virginia Retirement System Virginia Gov

37 States That Don T Tax Social Security Benefits The Motley Fool

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Virginia State Income Tax Rates And Who Pays In 2022 Nerdwallet